Furthermore, trucking is such a fragmented industry that there’s no data on specific carriers and drivers to differentiate their levels of service. As a result, they’re all grouped together like a commodity and priced the same.

Think about it, you may have owner operators in your network who are superior to the largest companies in regard to quality, but there’s no way to know, or let your shippers know.

Therefore, brokerages looking to stay competitive are already focusing on leveraging digitization, machine learning, and artificial intelligence. Subsequently, incumbents in the industry are already rapidly innovating and making capital expenditures on technology— from J.B. Hunt’s $500M investment to freight platforms startups raising over $490M, to technology-driven brokers such as Uber Freight and Convoy. These are innovative technologies and advancements for shippers and carriers.

Something all these innovators have done is recognize the importance of infrastructure investments to support their data collection and management efforts, with the ambition to apply advanced technologies, like A.I. and digital bookings, to increase firm productivity, defensibility and valuation.

However, brokerages shouldn’t be distracted by these technologies and trends!

"Digital freight matching, carrier relationship management systems, digitization, artificial intelligence, machine learning etc..”— these are all unhelpful things for most of the brokerage community members to talk about right now. It is not as simple as “flip a switch, get results”.

Without solid data collection, these emerging technologies would be impossible. Companies that want to leverage AI, ML, Digital Freight Matching, or other tech trends for their business, need to start by looking at the foundation. Without proper infrastructure, companies are truly putting the cart before the horse.

Why? Because Machine Learning (ML) and Artificial Intelligence (AI) technologies are only going to be as good as the data they use to generate solutions. And in our experience, every company we've come across— from 50 million to billions in revenue, and private to publicly traded— none of them have a comprehensive infrastructure to collect and manage all their carrier data and use information across a system of intelligence.

In this post, we share the essential attributes of the technology infrastructure your brokerage needs to stay competitive and succeed, now and into the future. Understanding and prioritizing the adoption of this comprehensive infrastructure will save you wasted time, money, and resources on any new technology initiative.

Cart Before the Horse

If Google was running off the training data of a hundred people instead of billions or only modularizing webpages on a portion of the internet— how helpful would your search results be? Not very helpful.

In the case of freight brokerages, an Armstrong & Associates report states that 90% or more of vital carrier data disappears into thin air!

Now, a lot of brokerages have their own Transport Management Systems (TMS) and their own freight matching algorithms. The purpose of having digital freight matching algorithms is to help brokers find the right carrier for shippers at the right price and the right time.

But how effective are digital freight matching algorithms going to be if freight brokerages, 3PL’s and Freight management companies are only using 10% of the required vital carrier data?

Not very effective at all.

Think about all digital initiatives as the building blocks of the house— machine learning products, digital freight matching, and carrier relationship management systems, for example. The foundation of all these digital initiatives is a comprehensive infrastructure that helps you collect, manage, and clean all your data.

If you build a house on a weak foundation, and you keep adding levels and complexity to that building— it’ll eventually fall apart. This is the business risk for transportation providers putting the “Cart before the horse” when thinking about their digital strategy.

Brokerage Data Infrastructure: What You Need to Collect, Store, Clean, and Manage

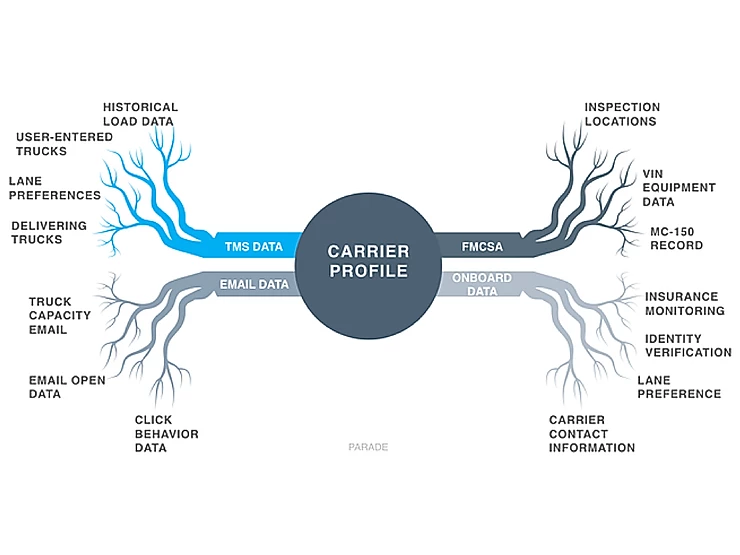

Before you get into machine learning, digital freight matching, and carrier relationship management systems, step back and think about what vital carrier data you need to collect.

(Hint: It’s much more than carrier location data.)

Most brokerages today are dependent on a TMS as a primary system of data and decision-making. But this system is monolithic. You need a new system that can collect, clean, and manage the following carrier data:

- Email data

- Location data and ELD data — historic and real-time

- Lane preferences

- Carrier equipment types

- Engagement data

- Federal Motor Carrier Safety Administration (FMCSA) data

- Government and regulatory information such as licenses

— you need to start with these as a strong foundation in this new Carrier Intelligence Game.

- What shipments carriers like to move.

- When those carriers like to move those shipments.

- Where those carriers they like to move them to.

- How much those carriers can quote for moving those shipments.

— this allows brokerages to deliver carriers targeted engagement in a predictive fashion, resulting in more consistent capacity for their carriers, and more profitable transactions for the brokerage.

Brokerages Should Still Prioritize Digitization to Secure Market Share

Transportation as a vertical is big and no winner has been defined; it is important to secure your market share early and make a transition to a digital brokerage. Freight brokerages and 3PL's need to find an efficient and effective way to leverage technologies to stay competitive and preserve their special businesses they have built from scratch with their own hands.

Transitioning to a digital brokerage and using carrier relationship intelligence will help brokerages create a more defensive and lucrative firm, empowering them to successfully compete with incumbent, established brokerages, and new venture and private equity backed competitors.

However, brokerages must first have a robust knowledge base of data, which includes data on thousands of carrier organizations. With the right infrastructure to collect, clean, and maintain data, AI in brokerages can effectively do the following at speed and scale:

- Learn from every carrier interaction to build intelligent carrier profiles, without manual data entry.

- Work with your existing matching and Transportation Management Systems to find the lowest risk/highest margin carriers for your carrier sales teams.

The brokerages with the right technology infrastructure and AI will be growing smarter every day, assisting them to:

- Grow carrier sales

- Create consistent capacity for carriers

- Deliver targeted carrier engagement

- Improve team productivity

- Strengthen carrier and customer relationships

— and even digitally book portions of their freight. Doing this without the right infrastructure and intelligence is like putting the Cart Before The Horse, it won't get you very far.

This post was made co-posted by Parade & CarrierDirect, with contributions from Preet Sivia, Peter Rentschler, and Ryan Schreiber.